This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Probe Gold News

Probe Metals More than Doubles Gold Resource to 866,300 Measured & Indicated Ounces and 2,293,500 Inferred Ounces at the Val-d’Or East Project

Highlights:

- The resource estimate at the Val-d’Or East Project demonstrates continued expansion of the gold resource, addition of new resource zones and potential future resource upside

- Val-d’Or East Property (100% interest)

- Pit-Constrained resource at 0.5 grams of gold per tonne (“g/t Au”) cut-off:

- 352,900 ounces of gold averaging 1.98 g/t Au in the measured category

- 380,200 ounces of gold averaging 1.49 g/t Au in the indicated category

- 1,049,200 ounces of gold averaging 1.44 g/t Au in the inferred category

- Underground resource at 1.95 g/t Au cut-off:

- 49,200 ounces of gold averaging 4.00 g/t Au in the measured category

- 84,000 ounces of gold averaging 3.85 g/t Au in the indicated category

- 679,600 ounces of gold averaging 3.49 g/t Au in the inferred category

- Pit-Constrained resource at 0.5 grams of gold per tonne (“g/t Au”) cut-off:

- Val-d’Or East Optioned Properties (option to earn 60% interest)

- Monique deposit: 396,800 ounces of gold averaging 2.25 g/t Au in the inferred category using a cut-off grade of 0.5 g/t Au for the Pit-constrained and 1.95 g/t Au for the underground, net to Probe

- Sleepy deposit: 167,900 ounces of gold averaging 4.70 g/t Au in the inferred category at 3.0 g/t Au cut-off, Cadillac Break East property, net to Probe

- Land consolidation strategy paying off with the discovery of significant gold deposits, Courvan and Monique

- Continue to advance the project with further drilling programs, metallurgical work, environmental and engineering studies

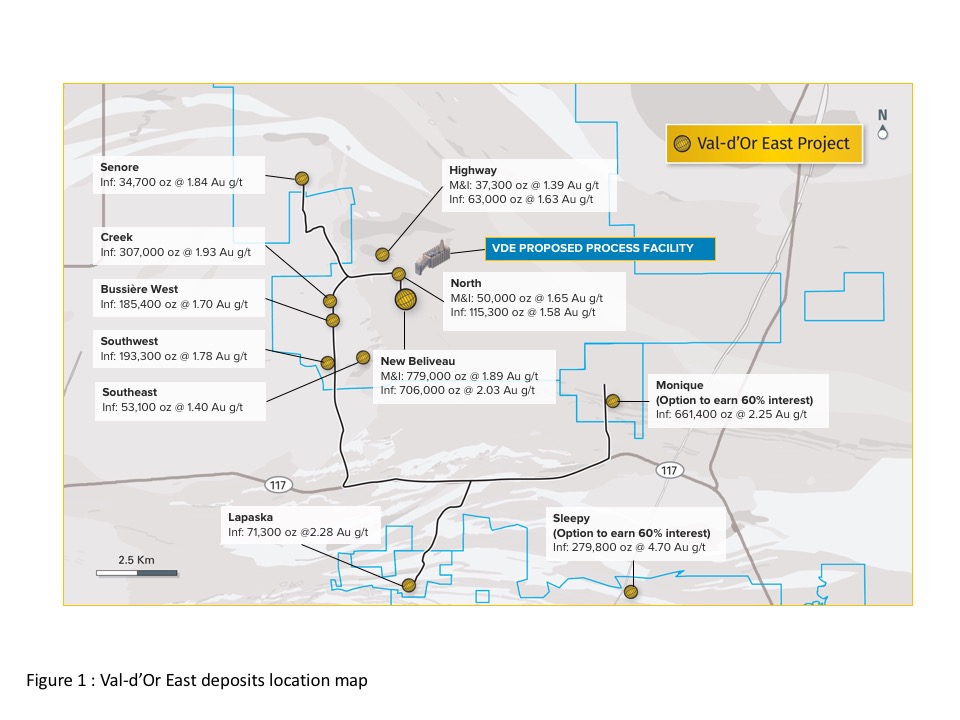

Toronto, September 3, 2019 – Probe Metals Inc. (TSX-V: PRB) (OTCQB: PROBF) (“Probe” or the “Company”) is pleased to announce the release of an Updated Resource Estimate for its Val-d’Or East project (the “Project”) located near Val-d’Or, Quebec. The estimate includes resources from the Company’s 100%-owned Pascalis, Courvan and Lapaska properties as well as its two option properties, Monique and Cadillac Break East. With the discovery of a new parallel gold trend, the Courvan Trend, the mineral resources have shown significant improvement over the previous resource estimate and remain open in all directions for future expansion. This resource estimate was independently prepared by GoldMinds Geoservices Inc. in accordance with National Instrument 43-101 (“NI 43-101”) and is dated August 28, 2019. Drills will be active throughout 2019 on further expansion and regional exploration.

David Palmer, President and CEO of Probe, states, “Our exploration programs have resulted in an impressive amount of growth, more than doubling our gold resource with 2.3 million ounces in the inferred and approaching 1 million ounces in the measured and indicated, which position the project as one of the top undeveloped gold deposits in the Val-d’Or area. The updated resource also highlights and confirms the potential of the area for continued growth and new discoveries. We have now increased the number of individual deposits from four to ten, including five within the new 100%-owned Courvan Trend. The majority of the increased resource was in pit-constrained ounces as the focus of the 2018-2019 programs was on shallow drilling. In addition to future pit expansion, the deposits are all open below the conceptual pits and still have potential for substantial growth at depth. With this updated resource I believe we have crossed a threshold and future programs will now include work on potential development scenarios in addition to resource growth. Probe will continue to focus on unlocking value for our Investors at its Val-d’Or East project and we are looking forward to the next phase of the project as we advance towards development.”

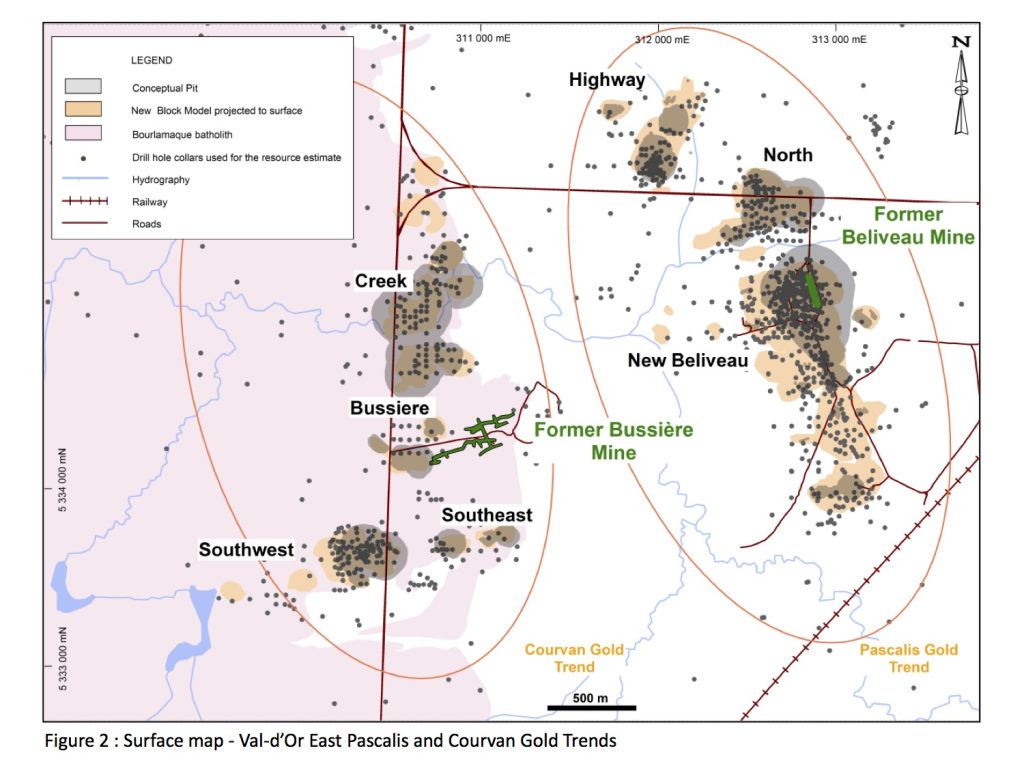

Val-d’Or East Project – Summary of Mineral Resources

The Val-d’Or East Project is 100% owned by Probe and includes the properties on the Pascalis Gold Trend and the properties on the Courvan Gold Trend as well as the Lapaska property. Since 2016, the Company has pursued land consolidation in the Val-d’Or district to cover extensions as well as prospective parallel trends to the New Beliveau deposit. The most notable acquisition was the Courvan property in 2017, which unlocked exploration potential to the west of New Beliveau and led to the identification of a significant mineralized gold trend parallel to Pascalis. The total Val-d’Or East land position now stands at 334 square kilometers and represents one of the largest land holdings in the Val-d’Or mining camp.

Table 1: Val-d’Or East Property (100% interest)

| All Deposits / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade(Au g/t) | Gold(oz.) | Tonnes | Grade(Au g/t) | Gold(oz.) | Tonnes | Grade(Au g/t) | Gold(oz.) | |

| Measured | 5,554,800 | 1.98 | 352,900 | 382,700 | 4.00 | 49,200 | 5,937,500 | 2.11 | 402,100 |

| Indicated | 7,956,200 | 1.49 | 380,200 | 678,100 | 3.85 | 84,000 | 8,634,300 | 1.67 | 464,200 |

| Measured & Indicated | 13,511 100 | 1.69 | 733,100 | 1,060,700 | 3.91 | 133,200 | 14,571,800 | 1.85 | 866,300 |

| Inferred | 22,680,300 | 1.44 | 1,049,200 | 6,060,200 | 3.49 | 679,600 | 28,740,500 | 1.87 | 1,728,800 |

As part of the land consolidation strategy for its Val-d’Or East project, Probe entered into an option agreement with Alexandria Minerals Corporation (now with O3 Mining Inc.) on November 28, 2016, whereby Probe has the right to earn an initial 60% interest in the Cadillac Break East Property, which includes the Sleepy deposit. On January 17, 2017, the Company signed an option agreement with Richmont Mines Inc. (now with Monarch Gold Corporation), whereby Probe has the right to earn a 60% interest in the Monique Property. The details of both agreements are described in the Company’s press release dated December 1, 2016, and January 17, 2017, respectively.

Table 2: Val-d’Or East Optioned Properties (option to earn 60% interest)

| Deposit / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade(Au g/t) | Gold(oz.) | Tonnes | Grade(Au g/t) | Gold(oz.) | Tonnes | Grade(Au g/t) | Gold(oz.) | |

| MoniqueTotal Inferred | 5,583,200 | 1.71 | 307,000 | 3,543,300 | 3.11 | 354,400 | 9,126,500 | 2.25 | 661,400 |

| Probe 60% Inferred Monique | 3,349,900 | 1.71 | 184,200 | 2,126,000 | 3.11 | 212,600 | 5,475,900 | 2.25 | 396,800 |

| Sleepy1Total Inferred | 1,855,300 | 4.70 | 279,800 | 1,855,300 | 4.70 | 279,800 | |||

| Probe 60% Inferred Sleepy | – | – | – | 1,113,200 | 4.70 | 167,900 | 1,113,200 | 4.70 | 167,900 |

1 NI 43-101 Technical Report Sleepy Project – December 2014

Additions to the Current Resource Estimate Relative to the 2018 Resource Estimate

The 2018 mineral resource estimate hosted a NI 43-101 resource of 682,400 ounces of gold indicated and 722,100 ounces of gold inferred. In using a gold price of USD $1,350 per ounce, the updated NI 43-101 mineral resource hosts 866,300 ounces of gold measured and indicated, and 2,293,500 ounces gold inferred, net to Probe. A total of 84.6% of the measured and indicated resources are in pit-constrained.

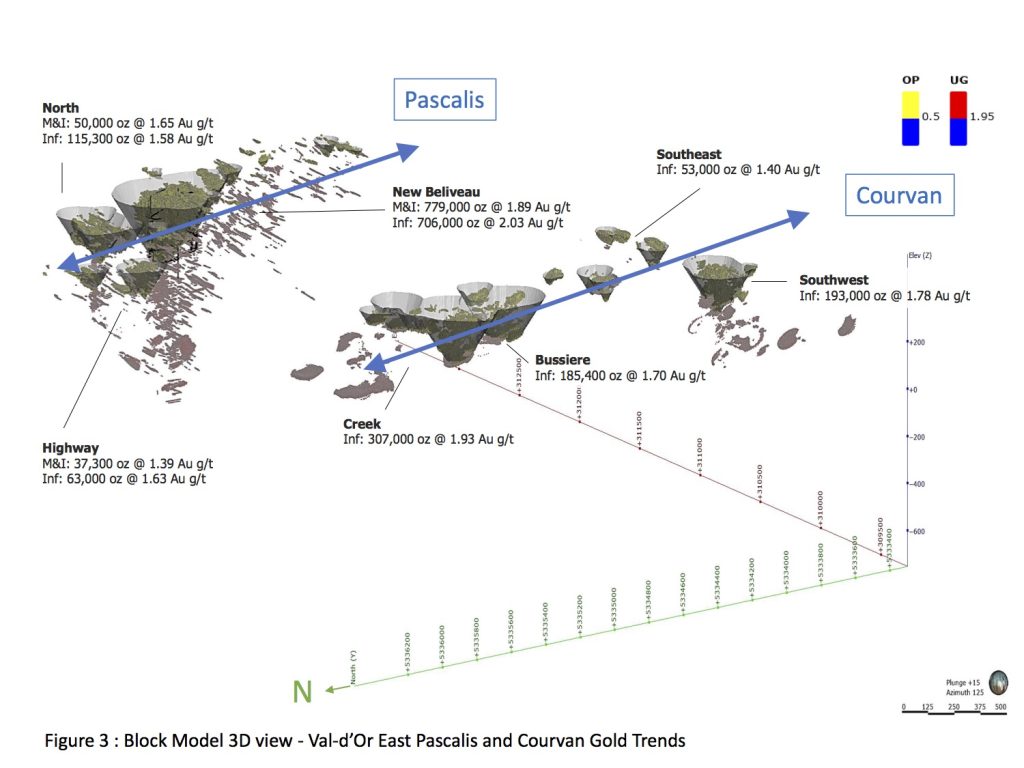

On the Pascalis Trend, the majority of the new pit-constrained resource estimate occurs within the central New Beliveau deposit, which totals 662,500 ounces measured and indicated at 1.74 g/t gold and 406,500 ounces inferred at 1.49 g/t gold. The underground mineral resource estimate for the New Beliveau deposit is 116,400 ounces measured and indicated at 3.89 g/t gold and 299,300 ounces inferred at 3.98 g/t gold. Since the February 2018 resource estimate, new drilling has been successful in connecting the South zone with the New Beliveau deposit. As a result, the new resources are now combined and reported together.

The Courvan Gold Trend was drilled by the Company in the fall of 2018 and since then approximately 33,000 metres of drilling was completed. The Courvan Trend includes the Bussiere, Creek, Senore, Southwest and Southeast deposits which together host 773,400 ounces inferred at 1.80 g/t gold.

Table 3: Val-d’Or East Project – Detailed Resources

| Deposit / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au g/t) | Gold(oz.) | Tonnes | Grade (Au g/t) | Gold(oz.) | Tonnes | Grade (Au g/t) | Gold(oz.) | |

| New Beliveau Deposit – Pascalis Gold Trend | |||||||||

| Measured | 5,230,400 | 2.01 | 338,300 | 382,700 | 4.00 | 49,200 | 5,613,100 | 2.15 | 387,600 |

| Indicated | 6,632,200 | 1.52 | 324,200 | 547,500 | 3.82 | 67,200 | 7,179,600 | 1.70 | 391,400 |

| Mes & Ind | 11,862,600 | 1.74 | 662,500 | 930,200 | 3.89 | 116,400 | 12,792,700 | 1.89 | 779,000 |

| Inferred | 8,485,400 | 1.49 | 406,500 | 2,336,400 | 3.98 | 299,300 | 10,821,800 | 2.03 | 705,800 |

| North Deposit – Pascalis Gold Trend | |||||||||

| Measured | 90,600 | 1.30 | 3,800 | _ | _ | _ | 90,600 | 1.30 | 3,800 |

| Indicated | 745,500 | 1.32 | 31,700 | 107,800 | 4.20 | 14,600 | 853,300 | 1.69 | 46,200 |

| Mes & Ind | 836,100 | 1.32 | 35,500 | 107,800 | 4.20 | 14,600 | 944,000 | 1.65 | 50,000 |

| Inferred | 1,895,950 | 1.27 | 77,400 | 373,200 | 3.16 | 37,900 | 2,269,200 | 1.58 | 115,300 |

| Highway Deposit – Pascalis Gold Trend | |||||||||

| Measured | 233,800 | 1.44 | 10,800 | _ | _ | _ | 233,800 | 1.44 | 10,800 |

| Indicated | 578,500 | 1.31 | 24,300 | 22,800 | 3.00 | 2,200 | 601,300 | 1.37 | 26,500 |

| Mes & Ind | 812,300 | 1.35 | 35,100 | 22,800 | 3.00 | 2,200 | 835,100 | 1.39 | 37,300 |

| Inferred | 875,4000 | 1.10 | 31,000 | 323,300 | 3.08 | 32,000 | 1,198,700 | 1.63 | 63,000 |

| Southwest Deposit – Courvan Gold Trend | |||||||||

| Inferred | 2,583,300 | 1.38 | 114,700 | 791,500 | 3.09 | 78,600 | 3,374 800 | 1.78 | 193,300 |

| Southeast Deposit – Courvan Gold Trend | |||||||||

| Inferred | 1,125,300 | 1.35 | 48,700 | 50,500 | 2.69 | 4,400 | 1,175,800 | 1.40 | 53,100 |

| Bussiere Deposit – Courvan Gold Trend | |||||||||

| Inferred | 2,882,200 | 1.53 | 141,700 | 511,400 | 2.66 | 43,700 | 3,393,600 | 1.70 | 185,400 |

| Creek Deposit – Courvan Gold Trend | |||||||||

| Inferred | 3,771,600 | 1.43 | 173,600 | 1,176,100 | 3.53 | 133,400 | 4,947,700 | 1.93 | 307,100 |

| Senore Deposit – Courvan Gold Trend | |||||||||

| Inferred | 548,800 | 1.78 | 31,400 | 37,800 | 2.68 | 3,300 | 586,800 | 1.84 | 34,700 |

| Lapaska Deposit | |||||||||

| Inferred | 512,400 | 1.47 | 24,200 | 459,800 | 3.19 | 47,200 | 972,200 | 2.28 | 71,300 |

| Monique Deposit | |||||||||

| Inferred | 5,583,200 | 1.71 | 307,000 | 3,543,300 | 3.11 | 354,400 | 9,126,500 | 2.25 | 661,400 |

Notes:

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported inferred Resources are uncertain in nature and there has not been sufficient work to define these inferred resources as indicated or measured resources.

- The database used for this mineral estimate includes drill results obtained from historical to the recent 2019 drill program.

- Mineral Resources are reported at a cut-off grade of 0.5 g/t Au for the pit-constrained and 1.95 g/t Au for the underground scenarios. These cut-offs were calculated at a gold price of US$1,350 with an exchange rate of 1.333 US$/C$ per troy ounce.

- The pit-constrained resources were based on the following parameters: mining cost 3$/t, processing + G&A costs $21.50/t, transport cost to the central processing facility based on distance on existing roads @ $0.15/t.km, Au recovery 95%, pit slopes 55 degrees for all pits with the exception of Lapaska and Monique at 45 degrees.

- The geological interpretation of the deposits was based on lithologies and the observation that mineralized domains occur either within or proximal to sub-vertical diorite dykes or as low dipping quartz tourmaline vein sets.

- The mineral resource presented here were estimated with a block size of 5m X 5m X 5m for the pit-constrained and a block size of 3m X 3m X 3m for underground.

- The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped to 100 Au g/t applied on 3-meter composites for the pit-constrained and 1.5-meter composites for the underground.

- The mineral estimation was completed using the inverse distance to the square methodology utilizing three passes for New Beliveau, North and Highway. All other deposits were estimated using inverse distance to the square methodology utilizing two passes. For each pass, search ellipsoids followed the geological interpretation trends were used.

- The Mineral Resources have been classified under the guidelines of the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council (2014), and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administrators NI 43-101.

- In order to accurately estimate the resources, underground voids (shaft, ramp and drifts) and the existing pits were subtracted from the mineralized bodies modeled prior to the pit optimization.

- Tonnage estimates are based on rock densities of 2.8 tonnes per cubic metre for all the zone except Monique where a specific gravity of 2.85 was used. Results are presented undiluted and in situ.

- This mineral resource estimate is dated August 28, 2019 and the effective date for the drillhole database used to produce this updated mineral resource estimate is July 25, 2019. Tonnages and ounces in the tables are rounded to nearest hundred. Numbers may not total due to rounding.

- Additional details will be provided in the technical report.

To view the VDE deposits location map, deposits 3D views, please follow the links below:

Figure 1: VDE deposits Location Map

Figure 2: Surface map – Pascalis and Courvan Gold Trends

Figure 3: Block Model 3D view – Pascalis and Courvan Gold Trend Area

Figure 4: Block Model 3D view – Monique Gold Trends

The following sensitivity table presents the current resource estimate at different cut-offs.

Table 4: Val-d’Or East Project – Resource Sensitivity by Cut-Off Grades

| Resources Category | Cut-Off Grade | Tonnes | Grade(Au g/t) | Ounces (oz.) | Cut-Off Grade | Tonnes | Grade(Au g/t) | Ounces (oz.) |

| Pit-Constrained Resources | Underground Resources | |||||||

| Measured | 0.3 | 6,970,900 | 1.65 | 370,900 | 1.75 | 444,200 | 3.70 | 52,900 |

| 0.5 | 5,554,800 | 1.98 | 352,900 | 1.95 | 382,700 | 4.00 | 49,200 | |

| 0.7 | 4,551,700 | 2.28 | 333,800 | 2.15 | 334,200 | 4.28 | 46,000 | |

| 1.0 | 3,516,400 | 2.70 | 305,700 | 2.45 | 271,200 | 4.75 | 41,400 | |

| Indicated | 0.3 | 11,218,500 | 1.17 | 421,300 | 1.75 | 798,700 | 3.55 | 91,100 |

| 0.5 | 7,956,200 | 1.49 | 380,200 | 1.95 | 678,100 | 3.85 | 84,000 | |

| 0.7 | 5,932,100 | 1.79 | 341,700 | 2.15 | 584,700 | 4.14 | 77,800 | |

| 1.0 | 4,072,900 | 2.23 | 291,700 | 2.45 | 473,100 | 4.58 | 69,600 | |

| Inferred | 0.3 | 32,835,600 | 1.11 | 1,167,200 | 1.75 | 7,040,200 | 3.26 | 737,900 |

| 0.5 | 22,680,300 | 1.44 | 1,049,200 | 1.95 | 6,060,200 | 3.49 | 679,600 | |

| 0.7 | 16,901,100 | 1.72 | 932,300 | 2.15 | 5,220,600 | 3.72 | 624,400 | |

| 1.0 | 11,786,200 | 2.10 | 794,900 | 2.45 | 4,013,000 | 4.15 | 535,000 | |

| Inferred including 60% Monique | 0.3 | 37,425,500 | 1.14 | 1,367,100 | 1.75 | 9,525,400 | 3.17 | 971,800 |

| 0.5 | 26,030,200 | 1.47 | 1,233,400 | 1.95 | 8,186,200 | 3.39 | 892,300 | |

| 0.7 | 19,516,000 | 1.76 | 1,102,600 | 2.15 | 6,882,900 | 3.64 | 806,200 | |

| 1.0 | 13,694,800 | 2.15 | 946,100 | 2.45 | 5,261,500 | 4.06 | 686,500 |

Resource Estimation Methodology and Parameters

As part of the resource estimation process, the Company and GoldMinds compiled, verified and modelled all technical information available from the Project, including 2,924 drill hole collars consisting of 296,090 gold assays, which represented 314,653 metres of drilling, and 634 surface channel samples. 3D geological models were built for sub-vertical structures and shallow dipping veins and included key structures hosting and constraining gold mineralization along the Pascalis Trend (New Beliveau, North Zone and Highway deposits), Courvan Trend (Southwest, Southeast, Senore, Bussiere and Creek zones), Monique and Lapaska deposits.

Next Steps

A technical report with respect to the latest mineral resource estimate disclosed today will be filed within 45 days in accordance with NI 43-101. The report will also present current work to advance the project, including latest metallurgical testwork results, and preliminary environmental characterization and baselining.

The resource estimate highlights multiple priority targets for resource expansion. For the remainder of 2019, the exploration program will focus on resource expansion, the potential discovery of additional new mineral resource zones and infill drilling for current resource in preparation for a future resource update. The Company will continue to advance and de-risk the project with further engineering (mostly metallurgical, mining) and environmental studies.

About the Val-d’Or East Project

Since 2016, Probe Metals has been consolidating its land position in the highly prospective Val-d’Or East area in the province of Quebec. The Val-d’Or East project is a district-scale land package comprising 334 square kilometers and represents one of the largest land holdings in the Val-d’Or mining camp. The property is host to three past producing mines (Beliveau Mine, Bussiere Mine and Monique Mine) and falls along four regional mine trends, including 14 kilometres of strike length along the prolific Cadillac Break. Val-d’Or East is situated in a politically stable and low-cost mining environment that hosts numerous active producers and mills.

Independent Qualified Persons

The Mineral Resources prepared for Probe Metals Inc. under the supervision of GoldMinds Geoservices (“GMG”). The Qualified Persons (“QPs”) have reviewed and approved the content of this news release. Independent QPs from GMG who have prepared and supervised the preparation of the technical information relating to this Mineral resource estimates:

- Merouane Rachidi, Ph. D., P.Geo.,

- Claude Duplessis, Eng.,

The technical content of this press release has been reviewed and approved by Mr. Marco Gagnon, P.Geo., Executive Vice President of Probe Metals Inc. and Mr. Walter A. Dzick, MBA, P.Geo., Senior Resource Geologist of Probe Metals Inc.

Quality Control

During the 2018 and 2019 drilling program, assay samples were taken from the NQ core and sawed in half, with one-half sent to SGS Canada Inc., Activation Laboratories Ltd. or ALS Global and the other half retained for future reference. A strict QA/QC program was applied to all samples; which includes insertion of mineralized standards and blank samples for each batch of 20 samples. The gold analyses were completed by fire-assayed with an atomic absorption finish on 50 grams of materials. Repeats were carried out by fire-assay followed by gravimetric testing on each sample containing 5.0 g/t gold or more. Total gold analyses (Metallic Sieve) were carried out on the samples which presented a great variation of their gold contents or the presence of visible gold. Historical drilling program assay sampling procedures are disclosed in the NI 43-101 technical report: Mineral Resource Val-d’Or East Property – February 20, 2018.

About Probe Metals:

Probe Metals Inc. is a leading Canadian gold exploration company focused on the acquisition, exploration and development of highly prospective gold properties. The Company is committed to discovering and developing high-quality gold projects, including its key asset the Val-d’Or East Gold Project, Quebec. The Company is well-funded and controls a strategic land package of approximately 1,000-square-kilometres of exploration ground within some of the most prolific gold belts in Quebec. The Company was formed as a result of the sale of Probe Mines Limited to Goldcorp Inc. in March 2015. Newmont Goldcorp Corporation currently owns approximately 13.7% of the Company.

On behalf of Probe Metals Inc.,

Dr. David Palmer,

President & Chief Executive Officer

For further information:

Please visit our website at www.probemetals.com or contact:

Seema Sindwani

Director of Investor Relations

+1.416.777.9467

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.